Everything important to the savings facility

Save with us What you should know

Our savings facility offers members and their relatives the opportunity to invest their money securely and at fair conditions. In our FAQ, we answer the most important questions about deposits, interest rates, security and availability.

Transparency and security are our top priorities - so that your savings are in good hands.

Saving with the BBG

Explanation of our savings products

Savings deposits

The savings accounts have notice periods of 3 to 48 months. You can save at any time and for as long as you want. A minimum deposit of just 10 euros is required. The interest rates are variable. After a notice period of 3 months, you can dispose of your credit balance subject to the corresponding notice period. With a savings account with a 3-month notice period, you can withdraw up to 2,000 euros of your balance per calendar month.

Fixed-rate savings

From a minimum deposit of just EUR 2,500, we offer you a lucrative investment with a fixed term of 6 to 60 months and a fixed interest rate. You can dispose of your savings at the end of the fixed-interest period, subject to a 3-month notice period.

Growth savings - with rising interest rates

From a minimum deposit of just 2,500 euros, you can invest your money for up to 5 years. The fixed interest rate increases annually from the first to the fifth year. If you need your balance before then, you can withdraw it in full after 12 months at the earliest, subject to a 3-month notice period.

Installments/ VL savings - small steps towards your assets

You pay a fixed amount of EUR 30 or more into the installment savings contract every month for 6 years. Alternatively, as an employee you can invest up to 480 euros per year. That's 40 euros per month, which your employer will ideally pay in full. The interest rate is variable. At the end of the installment period, the accumulated balance is available to you on 01.01. of the following year.

Crediting of savings interest

For all savings products, savings interest is generally credited on December 31 of a calendar year.

Termination

Notice of termination of your savings deposit must be given in writing. It remains valid for four weeks. During this period, the terminated savings balance is available to you free of advance interest. The notice period depends on the savings deposit you have taken out. Fixed-interest contracts and growth savings contracts must be terminated no later than three months before maturity.

Powers of attorney

You can set up a power of attorney for your savings accounts during your lifetime and a contract in favor of third parties in the event of death. The powers of attorney are account-related and therefore do not automatically apply to all savings contracts. A joint appointment with the authorized representative is required to set up a power of attorney.

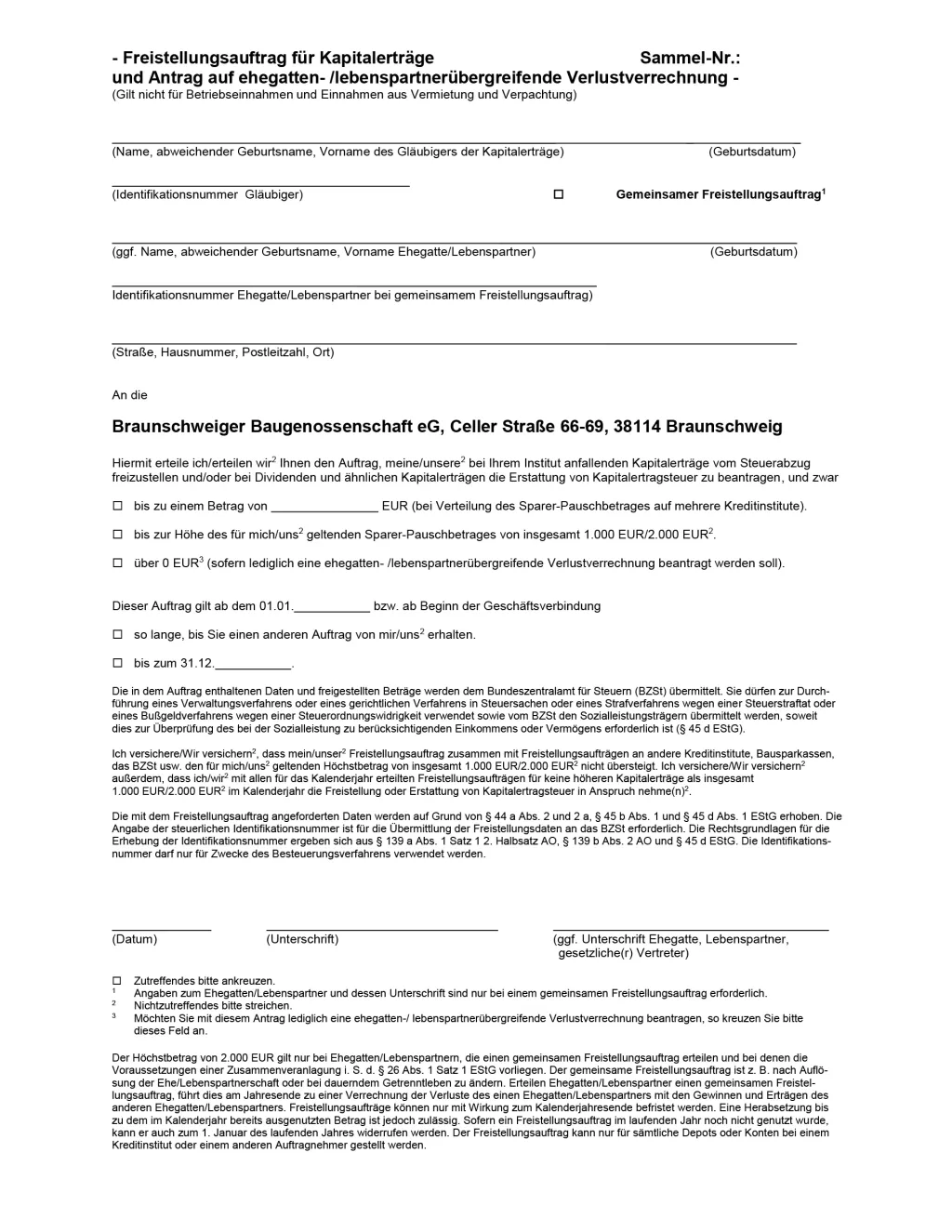

Exemption order

An exemption order can be submitted for your investment income (dividends + interest). Please use our form for this purpose. The exemption order can only be taken into account if it is submitted on time, i.e. before the interest is credited.

Who is allowed to save

The prerequisite for the acceptance of savings deposits is membership of the investor or a relative in the BBG. Savings accounts can be opened for individuals or spouses.

Deposits and withdrawals

Deposits and withdrawals are possible in cash and by bank transfer. Transfers are only possible to the account holder. We require a written order with a personal signature and a valid identity card must be presented or submitted.

Cash payments can be made by appointment at our administration office. For cash deposits of 10,000 euros or more, we must ask you to provide suitable proof of the origin of the money (e.g. withdrawal receipt from another bank, bank statement, etc.). Cash withdrawals of 5,000.00 euros or more must be notified at least one week in advance.

Account opening

To open a new savings account, a personal appointment at our administration office is required. Valid proof of identity and a personal tax ID are required to open the account.

Account closure

Savings accounts can be closed free of advance interest, subject to the required notice period. In the event of premature closure without notice, advance interest will be charged. The savings book, written instructions and valid identification must be submitted for the closure.

Account overview

All account movements can be found in your savings book. This will be handed over to you after the account has been successfully closed and should be submitted annually for the necessary supplements. Simply make an appointment with our savings department.

Savings account for minors

Savings accounts can be opened for minors. The savings contract must be signed by both legal guardians.

Download quickly and easily Important documents on the subject of saving

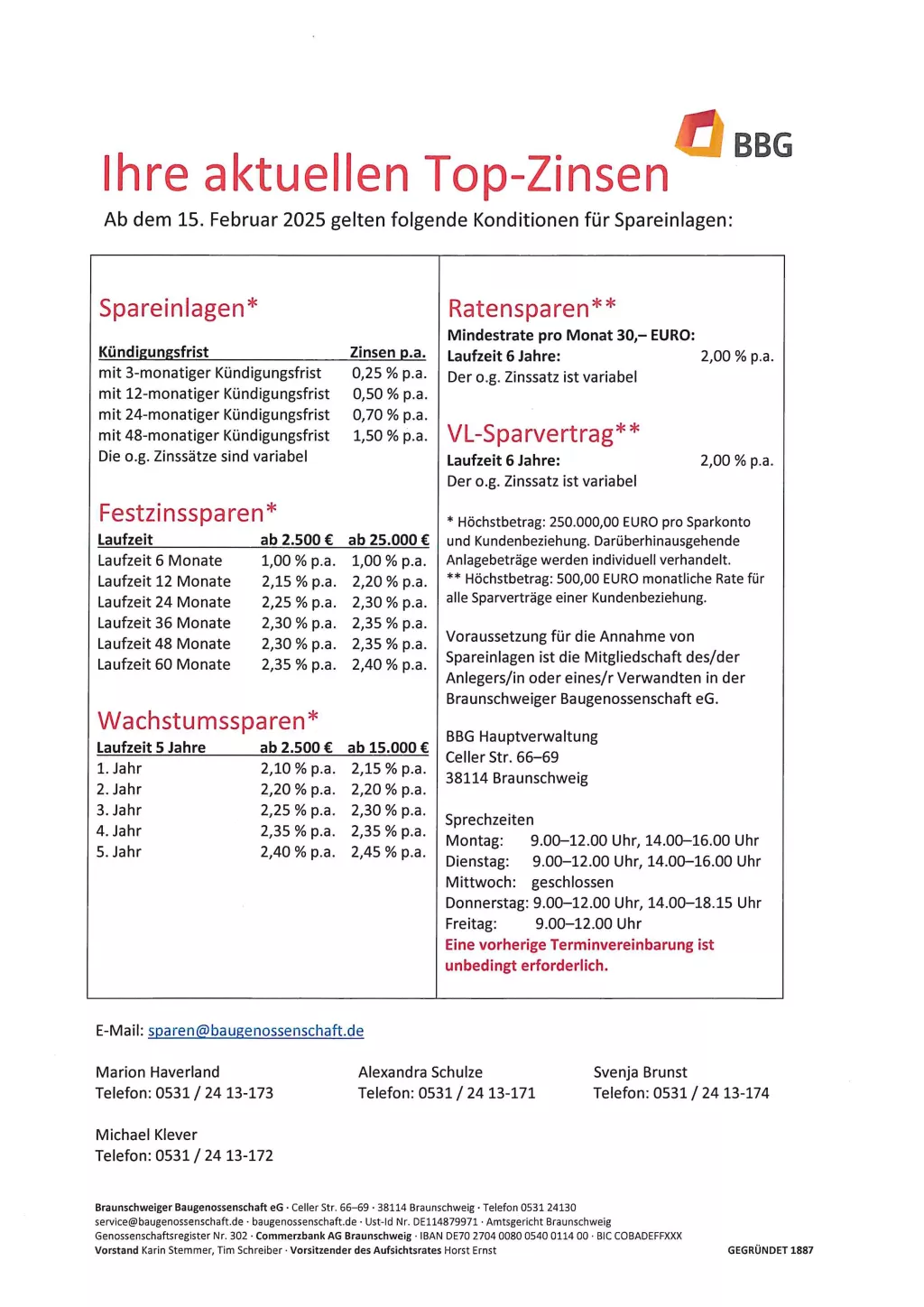

Current conditions (as at 15.02.2025)

Questions about our BBG savings products

BBG Savings Regulations (as at 01.06.2023)

BBG exemption order for your savings deposits

Notes on the procedure for deducting church tax